Index funds and exchange-traded funds (ETFs) are both popular investment vehicles that track the performance of a specific market index, such as the S&P 500 or the Nasdaq Composite. While they share similarities, there are some key differences between these two types of funds.

Index Funds

- Passively Managed: Index funds are passively managed, meaning that the fund manager does not attempt to outperform the market. Instead, they aim to replicate the performance of a specific index.

- Lower Costs: Index funds typically have lower expense ratios than actively managed funds, as they require less research and trading.

- Diversification: Index funds offer broad diversification, as they invest in a wide range of stocks within the index.

- Accessibility: Index funds are widely available and can be purchased through most brokerage accounts.

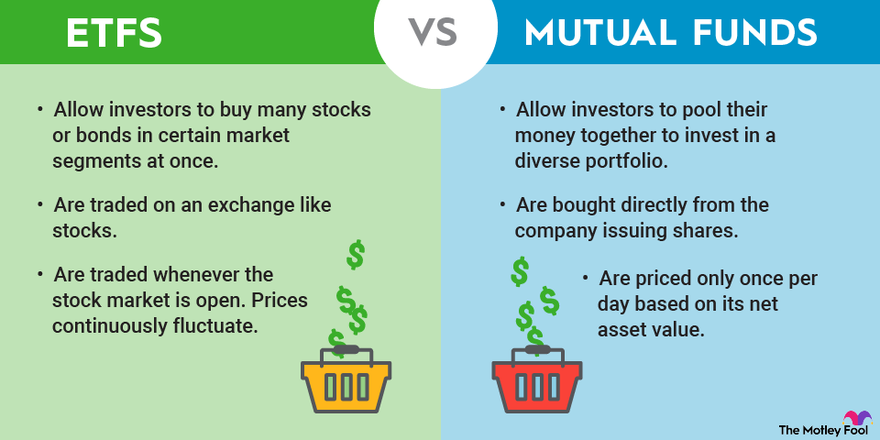

ETFs (Exchange-Traded Funds)

- Traded on Stock Exchanges: ETFs are traded on stock exchanges, allowing investors to buy and sell them throughout the trading day.

- Tax Efficiency: ETFs often offer tax advantages over mutual funds, as they can be traded like stocks.

- Leverage and Inverse ETFs: Some ETFs use leverage or inverse strategies to amplify returns or provide inverse performance.

- Specialized ETFs: ETFs can be designed to track specific sectors, industries, or geographic regions.

Key Differences

- Trading: ETFs can be traded throughout the trading day, while index funds are typically only traded once a day.

- Expenses: ETFs generally have lower expense ratios than mutual funds, but there may be additional trading costs.

- Tax Efficiency: ETFs can offer tax advantages over mutual funds, but this can vary depending on the ETF and your individual tax situation.

- Leverage and Inverse ETFs: ETFs can offer leverage or inverse strategies, which can amplify gains or losses.

Both index funds and ETFs are popular investment choices for investors seeking to track the performance of a specific market index. The best choice for you will depend on your investment goals, risk tolerance, and tax situation. It’s recommended to consult with a financial advisor to determine which option is right for you.

Leave a Reply